Trump’s 46% Tariff on Vietnam: What It Means—and Why IMCE Clients Should Stay Confident

1. Debunking the 90% Tariff Claim: What’s Really Behind the Numbers

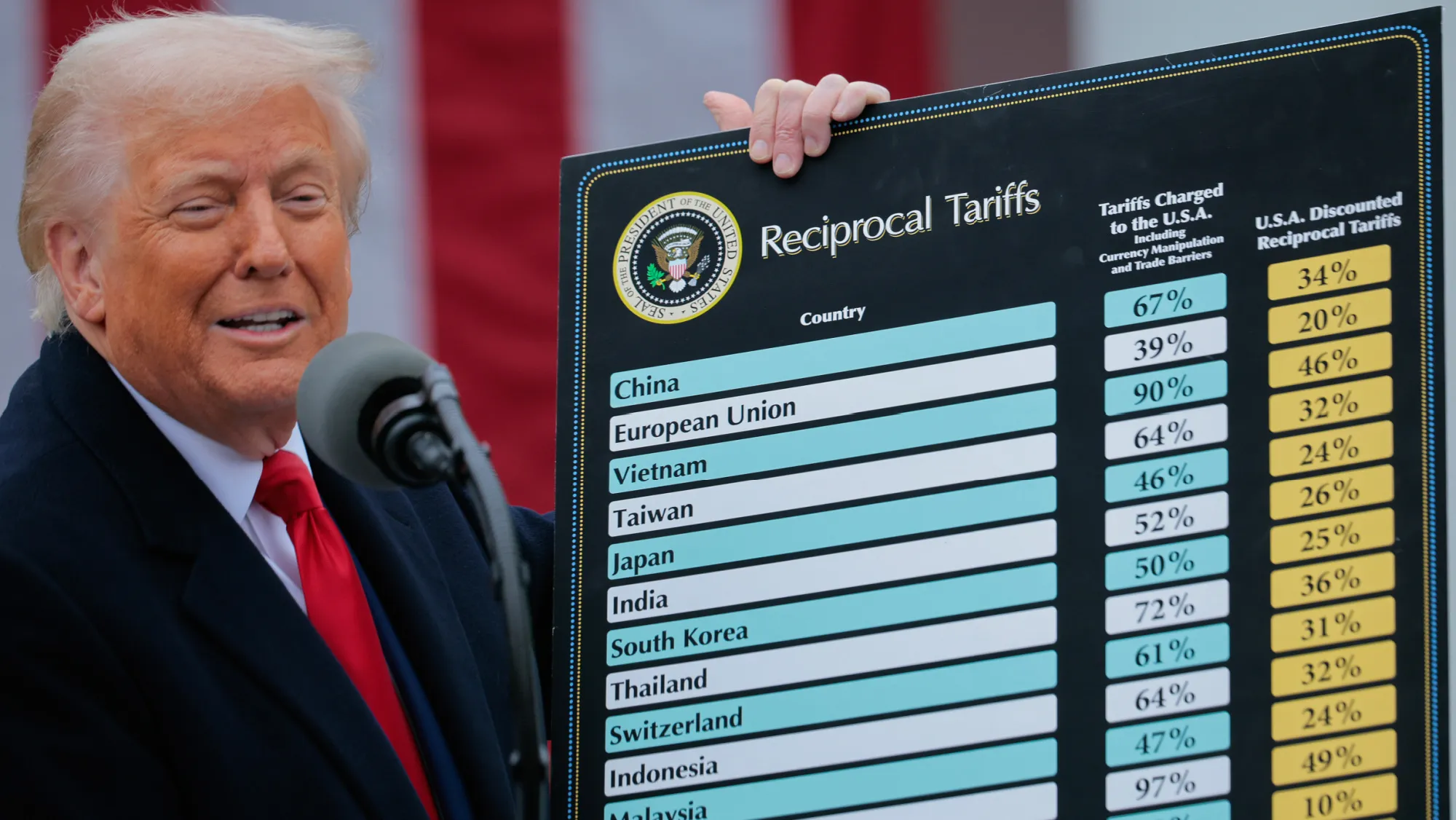

In early April 2025, former President Donald Trump announced a sweeping 46% tariff on Vietnamese imports, citing “unfair trade practices” and referencing an alleged 90% tax imposed by Vietnam on U.S. products.

This claim is not supported by real trade data.

According to the World Trade Organization (WTO) and the U.S. International Trade Administration, Vietnam’s average tariff on U.S. goods ranges from 10% to 20%, with the highest rates applied only to specific categories like autos or alcohol. The vast majority of American products—particularly those in tech, manufacturing, and agriculture—enjoy reduced duties under WTO rules and bilateral trade agreements.

The 90% figure, while attention-grabbing, is a selective interpretation of a few peak tariff cases, not the broader picture.

2. Vietnam’s Strategic Importance in the U.S. Trade Ecosystem

Vietnam is not only a major export partner but also a rising strategic ally of the United States. In 2023, the two nations upgraded their relationship to a Comprehensive Strategic Partnership, unlocking deeper cooperation in technology, investment, and security.

In previous periods of trade tension—such as under Trump’s first presidency—Vietnam proactively responded by:

- Increasing imports of U.S. goods (e.g., Boeing aircraft, agricultural commodities, LNG)

- Enhancing customs enforcement and cracking down on trade circumvention

- Addressing U.S. concerns around currency and fair market access

- Facilitating major U.S. investments in high-tech manufacturing, logistics, and energy

With these steps, Vietnam has demonstrated a clear commitment to balanced trade relations and compliance with international standards—something investors and business partners can take confidence in.

3. How IMCE Supports Businesses Navigating This Landscape

As a consulting and business development firm operating across trade, investment, media, and education, IMCE works at the intersection of policy, strategy, and execution.

We’re actively supporting our partners and clients in three key ways:

✅ Clarifying risk exposure: IMCE analyzes policy details, customs classifications, and tariff exemptions—so businesses know where they truly stand.

✅ Strategic market positioning: We help clients adjust sourcing, restructure supply chains, and adapt commercial models to remain competitive even in shifting trade climates.

✅ Diplomatic intelligence: IMCE monitors high-level U.S.-Vietnam developments, so our clients can stay ahead of potential policy turns—not just react to them.

Our role is to turn uncertainty into insight—and insight into action.

4. Exemptions That Matter: What Products Are Not Affected

According to the official White House Fact Sheet (April 2025), several key sectors are excluded from the proposed 46% reciprocal tariff, including:

- Steel, aluminum, and auto parts already covered under Section 232

- Energy products, semiconductors, copper, pharmaceuticals, and rare minerals

- Strategic materials imported under emergency or military procurement, according to 19 CFR §10.102

These exemptions cover much of the industrial, defense-related, and tech infrastructure supply chains—precisely the areas where Vietnam has become indispensable to U.S. companies.

📌 If you’re in manufacturing, logistics, energy, or advanced tech—there’s a strong chance you’re not affected at all.

5. What Businesses Should Expect—and How to Prepare

While political headlines can create volatility, recent examples from Mexico and Canada show that diplomacy works. Both nations saw earlier U.S. tariffs reversed after negotiation and strategic concessions.

Given Vietnam’s proactive stance, established trust, and deepening U.S. ties, we believe the current trade friction may be temporary and negotiable—not a long-term disruption.

At IMCE, we are working with clients to:

- Evaluate tariff exposure and explore exemptions

- Diversify supply networks, where necessary

- Engage with U.S. stakeholders to maintain open trade channels

- Leverage Vietnam’s strategic narrative as a stable, cooperative manufacturing hub

✅ Final Word from IMCE

We understand that U.S. businesses and investors are watching closely. The proposed 46% tariff sounds aggressive—but data, exemptions, and strategic positioning tell a very different story.

At IMCE, we are not only interpreting the policy—we are partnering